Will Delta Corp win this Bet?

When we talk about high-stakes gambling, places like Las Vegas or Atlantic City might pop up in our minds. But there’s a player in India too, Delta Corp, that has its own share of glitz and gamble. However, it’s not just the casino tables that are buzzing with high stakes; there’s a complex game of tax regulations being played out too.

Overview of Delta Corp and the High-Stakes Gambling Industry

Delta Corp isn’t just another company; it’s a significant name in the Indian gaming industry with a fancy casino on a cruise in Goa. It’s been sailing through the rough waters of Indian tax laws while offering a luxurious gambling experience to its patrons. But the stakes are high, not just on the gaming tables but in the realm of taxation, where a wrong move can cost a fortune.

Delta Corp was popular among investors because

Delta Corp had a certain allure for investors due to several factors:

Unique Market Position

Being the only and one of the biggest Casino Companies listed on exchanges made it a unique investment opportunity.

Debt-Free Status

Investors appreciate a debt-free company as it’s often seen as a lower risk investment. Delta Corp fit this bill perfectly.

Industry Growth

With tourism and gaming industries on a rise, Delta Corp was at the intersection of these growing sectors, making it an attractive investment.

Ace Investor’s Trust

The trust shown by ace investor Rakesh Jhunjhunwala, who held a significant stake in the company for many years, added a feather in Delta Corp’s cap, attracting more investors towards it.

Understanding the Tax Landscape for Casinos and Online Gaming

Taxing for casinos and online gaming in India is a complex affair. The recent introduction of Goods and Services Tax (GST) has shuffled the deck for companies like Delta Corp. The government decided to levy a 28% GST on the ‘Gross Bet Value,’ which turned out to be a game-changer, but not in a good way for the industry.

Delta Corp’s Tax Strategies and Challenges

The tax saga for Delta Corp began with a jaw-dropping tax notice of ₹16,822 crores, a figure way beyond its market value. The way Delta Corp calculated GST on ‘Gross Bet Value – Winning Amount,’ which essentially is the company’s revenue, came under scrutiny, leading to this massive tax demand. The timing was awful as their Chief Financial Officer resigned in August 2023, leaving the company in a financial pickle

Negative Consequences of the Heavy Tax Demand from Delta Corp

1. Unrecoverable Tax Amount:

- The GST Department’s aspiration to recover the full amount of the tax notice seems like a far-fetched dream. Delta Corp’s net worth is a mere 15-20% of the demanded amount, making full recovery an unrealistic expectation.

2. Loss of Future GST Collection:

- This tax debacle could potentially lead to a loss of future GST collections for the government. If Delta Corp, a significant player in the industry, faces such financial turmoil, it might deter other companies from venturing into this domain, thereby reducing the GST collection in the long run.

3. Tourism Setback, Especially for Goa:

- Delta Corp isn’t just a gaming company; it’s a significant contributor to the tourism sector, especially in Goa. If the company’s survival is threatened, it could lead to a substantial tourism loss for India, with Goa being hit the hardest.

4. Heavy Losses for Small and Retail Investors:

- The plummeting share prices post the tax notice announcement has already caused a stir in the market. Small and retail investors, who had put their faith and money in Delta Corp’s stocks, are facing heavy losses, which is a significant concern.

5. Negative Image for Future Investments:

- This incident casts a long shadow on the gaming and hospitality industry, creating a negative image for future investments. Investors might think twice before investing in this sector, fearing similar tax issues. This could stifle the growth and development of the gaming industry in India.

The ripple effects of the tax notice are far-reaching, impacting various stakeholders from the government to small investors. It’s a stark reminder of the delicate balance between regulation and the growth of the industry.

The Tax Maze

The tax maze isn’t new for Delta Corp. However, the retrospective calculation of GST from 1st July 2017 has opened a can of worms. Now, the company is navigating through a complex maze of regulations, with stakes higher than ever. The tax notice isn’t a passing cloud but a storm threatening to swallow its entire decade’s revenue.

Impact of GST Implementation on Delta Corp’s Tax Strategy

The GST mess triggered a free fall of Delta Corp’s share prices, dropping by 20% following the announcement. The market sentiment turned sour, with questions looming large over Delta Corp’s future. The GST issue isn’t just a Delta Corp problem but a systemic issue threatening the entire industry’s viability.

Case Studies: Successful Tax Management in the Gambling Industry

While Delta Corp is grappling with the tax storm, other global players in the gambling arena have managed to play their cards right. For instance, casinos in Nevada have a well-defined tax structure that fosters growth and ensures compliance. These case studies offer a ray of hope and a roadmap for navigating the tax maze.

The Future of Taxation in the High-Stakes Gambling Industry

The unfolding Delta Corp saga is a litmus test for the industry and the regulatory framework governing it. It highlights the need for a transparent, well-defined, and fair tax regime that fosters growth, ensures compliance, and builds investor confidence.

Latest News updates on Delta Corp from various sources

Tax Notice Impact:

- Delta Corp received a GST notice of ₹16,822 crore, causing a significant drop in its share prices.

- Following the tax notice, the share prices tanked by 20%.

- The shares slumped 15% and touched a 52-week low on BSE at ₹157.75 apiece according to a report by Mint.

Market Reaction:

- The tax notice has led to a negative sentiment in the market regarding Delta Corp’s stock.

- Questions are being raised on forums and news outlets regarding the future of Delta Corp, with headlines like “Delta Corp: Game over or will the house win as always?”.

Company Performance:

- Despite the recent tax notice, Delta Corp had seen a surge of 2% after ₹45.6-crore equity shares changed hands earlier in September 2023.

- The company operates casinos in India and the recent tax notice is seen as a significant setback.

Final Words

As Delta Corp awaits its fate, the entire gaming and hospitality industry is watching with bated breath. The dice have been rolled, and as the market awaits the outcome, Delta Corp’s financial ordeal narrates the larger challenges faced by the gaming and hospitality industry in India. The journey through Delta Corp’s tax maze is a high-stake gamble, a narrative that resonates from the vibrant casino floors to the opulent boardrooms.

FAQs

Is Delta Corp a prominent player in the high-stakes gambling industry?

Yes, Delta Corp is a big name in the Indian gaming and hospitality industry with a flagship casino on a cruise in Goa.

How does the tax landscape impact Delta Corp’s operations?

The tax landscape, especially the introduction of GST on ‘Gross Bet Value,’ has hit Delta Corp’s financial stability and market capitalization hard.

What are some successful tax strategies employed by Delta Corp?

Delta Corp initially calculated GST on ‘Gross Bet Value – Winning Amount,’ aligning it with its revenue, although this method has now come under scrutiny.

What are the future trends in taxation for the high-stakes gambling industry?

The future of taxation in the gambling industry hinges on a well-defined, transparent, and fair tax regime that fosters growth and ensures compliance.

Share this insight

Spread the Alpha

If this analysis helped you, pass it along to your trading desk or community.

Related Articles

More ideas that align with your trading playbook.

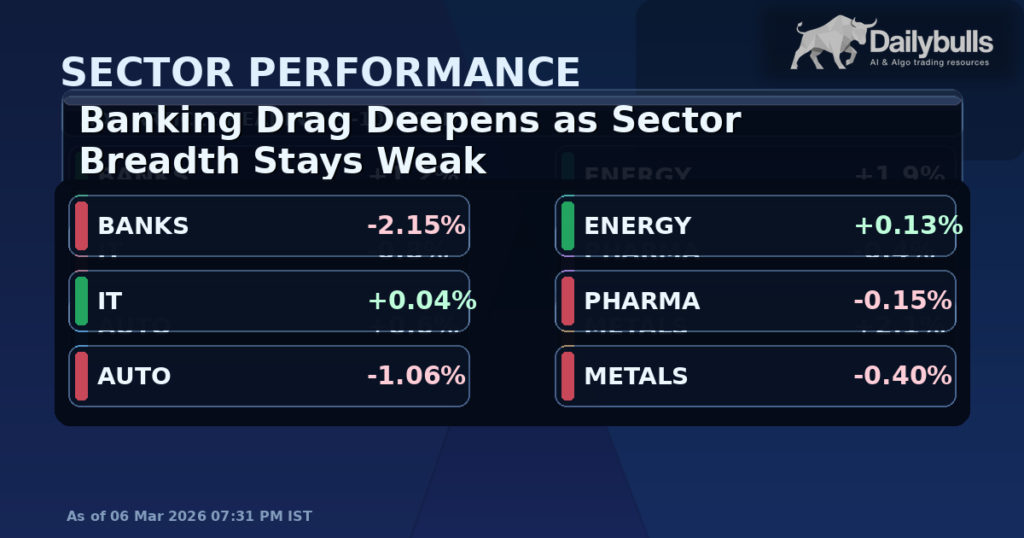

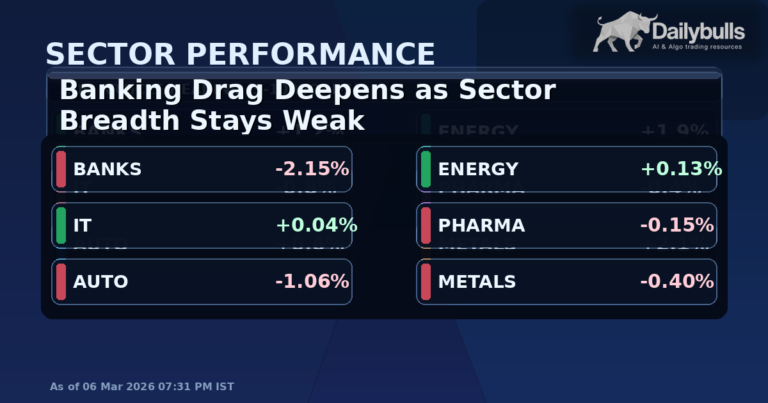

Sector Pulse: Banking Drag Deepens as Energy Holds Near Flat

Indian equities stayed under pressure in the latest session as banking weakness outweighed pockets of resilience in energy and IT. The broad…

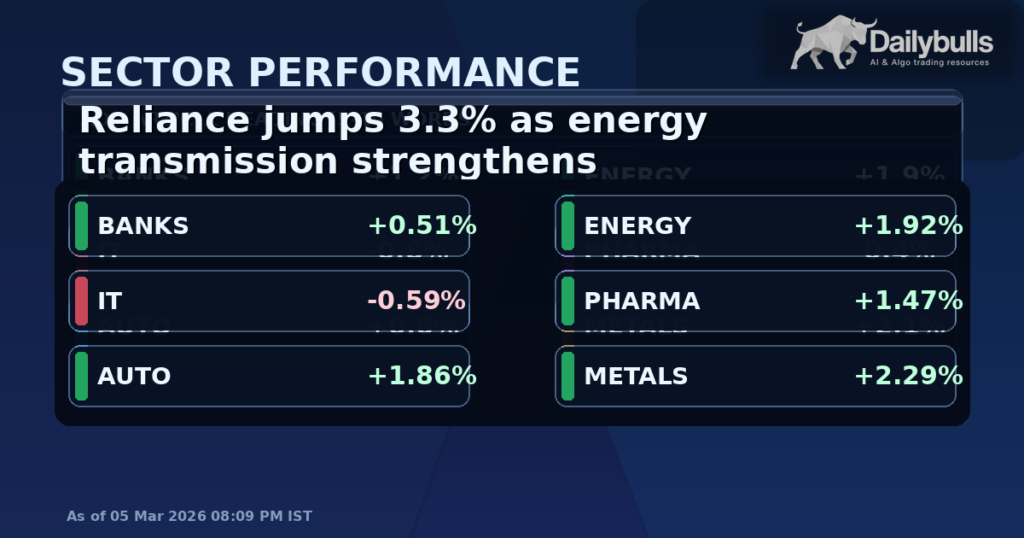

India EOD Wrap: Broad Risk Participation as Metals and Energy Lead

End-of-Day Market Wrap Indian equities closed higher in Thursday’s session, with Nifty 50 at 24,765.90 (+1.17%) and Sensex at 80,015.90 (+1.14%). The…

Reliance Leads Energy-Led Repricing at Close; What Changed and What to Watch Next Session

Indian markets closed with a clear energy-led tone on Thursday, with Reliance Industries among the day’s biggest large-cap movers. Reliance ended at…