Vodafone Idea Share price Target 2023, 2025, 2030

Pranay

Contributor

Vodafone and Idea were two premium mobile network operators in India before 2020. As the losses of both companies (Vodaphone and Idea) were hitting the roof, they had to merge in 2018. In this post, we will find Vodafone Idea share price target for 2023, 2025, and up to the year 2030. To find the Future price target of Vi, we will check its technicals and also study the company’s fundamentals.

The company which is now known as ‘Vi’ is now trading at ₹7. In 2015, its share price was ₹123. Since then, the stock is continuously declining. But now as Vodafone Idea has started to make higher highs on the weekly time frame, the question arises, if it is the right time to invest in Vi.

Company Details

Vodafone Idea Limited which is now known as Vi, is an Indian telecommunications company. It is a joint venture between Vodafone Group Plc and the Aditya Birla Group. Vodafone owns a 45.39% stake in the company, whereas the Aditya Birla Group holds 26% stake.

Vi offers a wide range of telecommunication services which includes mobile voice and data services, broadband services, and enterprise solutions. It provides prepaid and postpaid mobile plans and value-added services like caller tunes, international roaming, and mobile banking. Company website – MyVi

Vodafone Idea share price target

| Year | Vi Share Price Target (Rs) |

|---|---|

| 2023 | 9 |

| 2024 | 11 |

| 2025 | 23 |

| 2026 | 48 |

| 2027 | 71 |

| 2028 | 110 |

| 2029 | 118 |

| 2030 | 130 |

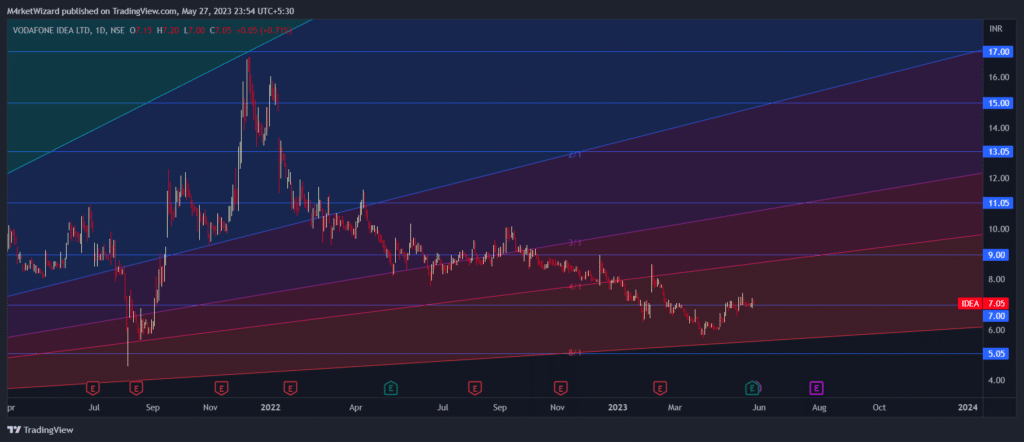

Above I have mentioned potential price targets for Vi for the coming years. Now lets study chart and analyse what we can expect in coming years.

Vodafone Idea share price target 2023

As investors, we might be well aware of the poor performance of Vi. But in 2023, the earning per share (ESP) for March 2023 improved compared to the previous year (March 2022). It went from -9.82 to -8.43, which means the company’s loss per share decreased. This is a good sign that the company is trying to reduce its losses.

Losses are part of the business. A loss-making company should not be considered as a bad company to invest in. Also, the telecommunication business is a capital intensive business. So its good that Vi is focusing on minimizing loses.

Vodafone Idea took support from 5.7 level and now slowly moving upside. We can see minor resistance near the 7.65 level, but ₹6 zone is a strong support, and it will be hard to break. For 2023 we can see targets up to ₹9 for Vodafone Idea.

Vodafone Idea share price target 2025

Vodafone Idea’s profitability for March 2023 improved compared to the previous year. The profit margins, such as PBDIT margin, PBIT margin, and net profit margin, showed better results, indicating a reduction in losses. As we discussed earlier, the company is not only working on reducing its losses but also working hard to increase its profit margins. This way they can become profitable.

Targets of Vodafone Idea for 2025 can be ₹13. And if the company continues to work on its financials, we can also see targets of ₹17.

Vodafone Idea Market Share compared to others

| Company | Market Share (As of 2022) |

|---|---|

| Vodafone Idea (Vi) | 23% |

| Bharti Airtel | 32% |

| Reliance Jio | 35% |

| BSNL | 10% |

Conclusion

As we know, healthy competition is always good for customers. After Jio introduced its free plans and unlimited data usage in 2020, most Indian telecom companies were left in shock. But if Vi continues to improve its balance sheet and provides quality customer experience, we will see all of the Vodaphone Idea share price targets will be achieved in the coming years.

Frequently Asked Questions

Is Vodafone Idea aloss making company?

Vi is a loss making company like MTNL and Reliance Communications.

Is Vodafone Idea undervalued or undervalued?

Vodafone Idea is at right valuation right now. Price of ₹7 justifies its valuation.

What are 52 week high and low of Vodafone Idea?

Vi’s 52 Week high is 10.20 and its 52 week low is 5.7

What are gann levels for Vodafone Idea?

Resistance 1: 8.26

Resistance 2: 9

Resistance 3: 9.76

Resistance 4: 10.56

Resistance 5: 11.39

Support 1: 6.25

Support 2: 5.64

Support 3: 5.06

Support 4: 4.51

Support 5: 4

Share this insight

Spread the Alpha

If this analysis helped you, pass it along to your trading desk or community.

Related Articles

More ideas that align with your trading playbook.

Amber Enterprises (BSE: 540902): Bullish Flag Pattern— Is the Upward Momentum Set to Continue?

Amber Enterprises (NSE:AMBER) (BSE:540902) is a small cap stock with MCAP of 15,364 crores and operates in the consumer durable sector. The…

Breakout stock for Swing Trade – Garware Technical Fibres (NSE:GARFIBRES)

Garware Technical Fibres Ltd. (NSE:GARFIBRES) (BSE:509557) works in the textile domain and is a leading manufacturer of technical fibres like fishing and…

Hindustan zinc rises before earning concall, Should you hold?

Hindustan Zinc which is listed on NSE under ticket (NSE:HINDZINC) marked a new all time high on April 12, 2024. The stock…

Your writing style is so engaging and easy to follow I find myself reading through each post without even realizing I’ve reached the end