Speciality Restaurants Limited (SPECIALITY) Stock Price Target Analysis for Tomorrow

Speciality Restaurants Limited

Symbol: NSE: SPECIALITY

Sector: Loading... / Loading...

Last Close: ₹148.68

Last Update: 2025-02-03

SPECIALITY Today’s Performance

SPECIALITY opened today at ₹153.48 and marked a high of ₹162.8. The low price was ₹146.25 and the stock finally closed at ₹148.68. This data is crucial to forecast SPECIALITY’s targets for tomorrow’s day trading session. Learn more

Today, shares of Speciality Restaurants Limited closed above previous closing, which is evident from the formation of Higher High. In the coming days, the stock may continue to rise, suggesting a bullish forecast.

Strength Matrix graph shows how SPECIALITY might perform tomorrow by highlighting its price strength, momentum, volatility, and trend direction. Tracking these short-term trends daily can help better understand changes in the market.

Strength Matrix

Technical overview of how the stock may perform in the upcoming session.

Technical Strength and weaknesses

Understanding strengths and weaknesses in technical indicators is important as these points will help to decide whether or not to trade SPECIALITY tomorrow.

Strengths

-

RSI suggests a strong market condition, which might indicate sustained buyer interest and potential for further gains.

-

Expect moderate bullish behavior.

-

ADX suggests a very strong bullish trend for tomorrow.

-

SAR shows a moderate bullish trend, with stable recent price actions above SAR points.

-

SAR signals a potential bullish reversal, possible upward movement.

Potential Weaknessess

-

The price is significantly below the SMA, highlighting strong bearish momentum with high market volatility and a consistent downward trend.

Similar Stocks like Speciality Restaurants Limited

Blog Updates

Loading posts...

Daily prediction for the week

| Day | Target Value |

|---|---|

| Monday | ₹158.90 |

| Tuesday | ₹162.80 |

| Wednesday | ₹169.13 |

| Thursday | ₹175.45 |

| Friday | ₹179.35 |

Possible short term targets for SPECIALITY in coming days if the stock remains bullish through the week.

- The initial target value for SPECIALITY on Monday is projected to be ₹158.90.

- With favorable market conditions, the target value on Wednesday could reach ₹169.13.

- By the end of the week, the target value for SPECIALITY on Friday is expected to potentially reach ₹179.35, considering bullish market trends.

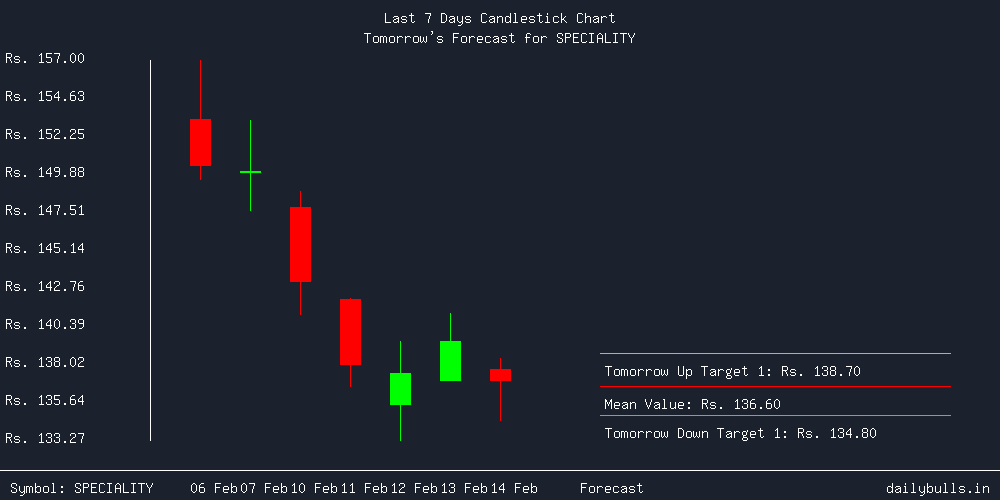

Tomorrow's price forecast review for SPECIALITY

Opening above mean value ₹152.58, will indicate bullish sentiment in Speciality Restaurants Limited. Any dip in price should be considered as an opportunity to Buy the stock. The maximum price that SPECIALITY can reach tomorrow will be 158.90 if the sentiments remains bullish. Reversal may happen if the price moves too far away from its mean.

If the price action is weak in the morning, then (symbol) may break below its mean. In such a case, keep the first target at 142.35 as minimum, and ₹125.80 as maximum.

Mean value also acts as Support when price is above and Resistance when price is below it. Day Traders can use this point to make long or short entries.

SPECIALITY’s Tomorrow's Forecast Based On Opening Price

1. Gap Up Opening

This section provides insights on how SPECIALITY may perform if it opens with a gap up tomorrow. Typically, opening 0.50% above previous close is considered as a valid gap.

1.1 Opening Above Today's Close but Below Resistance (158.90)

Trade: Enter a SELL position when the stock reaches ₹158.90.

Target: Keep target price at ₹152.58.

Rationale: This strategy aims to capture the early morning pullback move towards the mean value.

When to Avoid:

- Keep Stop Loss above 158.90 (5 min candle closing basis).

- Avoid when risk to reward is not favorable.

1.2 Opening Above Resistance (158.90)

Trade: Initiate a BUY position when the first candle (5 min) closes above 158.90

Target: Aim for the first target of 169.13 later, trail up to 175.45.

Rationale: SPECIALITY opening above Resistance (158.90) suggests a strong bullish sentiment. This way, traders can gain the advantage of a possible upmove.

When to Avoid:

- Remember to keep SL below 158.90.

- Do not trade this strategy if the stock is in a downtrend in the last 3 days.

2. Gap Down Opening

Opening below 0.3% of previous day close is considered as a gap down opening. Section below explains how SPECIALITY may perform considering price action after gap down opening.

2.1 Opening Below Today's Close but Above Low Price

Trade: Place a BUY order at ₹142.35.

Target: Place an exit order at ₹152.58 making it an intraday target.

Rationale: If SPECIALITY does not make a low below its previous low, the trend may still be higher highs on the daily timeframe. This presents us with a Buy opportunity once the price retraces downside near its support.

When to Avoid:

- Place SL below support 142.35.

- Do not trade this when close and low price are close to each other, or if the market is negative.

2.2Breaking Below Today's Low

Trade: Enter a SELL position in SPECIALITY when it finds resistance near 152.58.

Target: Aim for a minimum 1:1 risk-reward and keep a target of 142.35. Accuracy is better if this happens after 10:15 AM.

Rationale: Breaking below previous day low signifies bearish pressure. In case the stock retraces upside, it may present traders with a good opportunity to open a new sell position to gain benefit from the bearishness in stock.

When to Avoid:

- Exit if the stock closes above 152.58.

- Avoid selling when it's trading near a major support area.

Additional Note: If the trend is bullish on a higher timeframe, it is suggested to enter a long position instead when the share price reaches 142.35.

3. Flat Opening

SPECIALITY opening near previous day close price will be considered as a flat open. Below is detailed explanation of how stock may perform based on price action.

3.1) General Trend Overview

Since today was a bullish day in SPECIALITY, this trend might continue tomorrow as well. However, flat opening suggests neutral sentiments or contunuation of previous day trend. So this section will consider both cases depending on how price action is in the early morning session.

3.2) Bearish Price Action

Action: If price action is weak and the stock is making lows, traders can consider creating a (Sell) entry once the mean value 152.58 is broken.

Target: Aim for a target up to the previous day's low of 146.25 and after achieving TP1, extend targets further up to 158.90.

Rationale: This strategy leverages the bearish trend continuation after an initial flat opening.

3.3) Bullish Price Action

Action: If SPECIALITY starts the day on a bullish note, its targets will be 158.90 and 169.13.

Rationale: Using this intraday strategy, traders can capitalize on the bullish momentum.

When to Avoid:

- Keep SL below 152.58 on a candle closing basis (exit when a 5-minute candle closes below pivot).

- Avoid this trade if the previous day was in a downtrend.

SPECIALITY's vs. Nifty's Performance

Above charts shows close price comparison of SPECIALITY and Nifty 50 for past 7 days highligting how stocks performance compared to the flagship index.

Overview of Returns

| Period | SPECIALITY's Returns | Nifty's Returns |

|---|---|---|

| Daily | 12.91% | -0.63% |

| Weekly | 10.36% | 1.16% |

| Monthly | 2.35% | -2.68% |

Today, SPECIALITY returned 12.91% while the Nifty returned -0.63%.

Previous week, the stock returned 10.36% compared to 1.16% return of flagship index Nifty.

In the Last one month, shares of SPECIALITY presented return of 2.35%, where as Nifty stands at -2.68% returns.

SPECIALITY's Volatality Analysis

Chart above shows volatality and price comparison of SPECIALITY's over last 3 months. Volatality often referred to as IV is imporatnt in intraday trading since it gives insights on where stop loss and profit booking levels can be. For stock with higher volatality, its suggested to place a bigger stop loss since price movements can be aggressive.

Range Analysis

125.8

136.03

142.35

152.58

158.9

169.13

175.45

Predicted share price range for tomorrow is: High ₹157.96 and Low ₹151.

Should you hold SPECIALITY tomorrow?

Recommendation: Sell (Last Close Below Weekly Pivot)

Weekly Pivot Analysis

Last Close: ₹148.68

Weekly Pivot: ₹152.58

Status: The stock closed below the weekly pivot, indicating potential resistance and a negative outlook for tomorrow.

Why This Matters?

Pivot points are used to identify potential support and resistance levels. Stocks closing below the weekly pivot are considered to have a bearish sentiment, suggesting that the stock may decline, which is why a "Sell" recommendation is made.

Top Gainers

-

20%

-

18.37%

-

15.92%

-

6.22%

-

14.95%

Top Losers

-

-17.57%

-

-14.52%

-

-13.95%

-

-13.95%

-

-13.75%

Trending Stocks

-

38.99%

-

38.76%

-

35.16%

-

33.83%

-

33.75%

Stocks in Focus

Loading posts...