Navratna Power Company gets multiple order from Government – Delivers 344% Returns

Navratna company NLC India Ltd, listed on National Stock Exchange under ticker NSE: NLCINDIA declined by over 5% in intraday on the 12th of March.

With a market cap of ₹30,665 crores, NLC is a leading company engaged in the business of coal mining and power generation.

NLC India is facing some heat and with its share price declining for past 5 weeks. From its all time high of 293.75, the company has declined by 25% during this time.

With multiple orders in queue, what might be the reasons behind the fall in price of NLC? Let us address the performance of this power company below.

NLC receives multiple orders from Indian Government

On Monday, March 11, NLC signed a mutual agreement with the government of Rajasthan to form a joint venture to set up two plants. The company is in talks to establish a 125 MW lignite based thermal power plant. Another project is a solar power plant with 1000 MW production capacity.

NLC has also received orders for a thermal power plant in Odisha, with a combined capacity of 2400 MW. Various wind power projects were also backed by the company earlier this year.

NLC’s performance over last few years

NLC’s performance in 2023 was no less than a multi bagger. The stock price of company soared by over 400% last year, where its price went from ₹70 in Q1 2023 to ₹293 in January 2024.

This power company has also outperformed benchmark index in one and three years. While Nifty generated 73% returns, NLC delivered 344% of returns to its shareholders.

Returns generated by NLC in 5 years

| Time Period | Return |

|---|---|

| 7 Days | -2.3% |

| 30 Days | -12.5% |

| 1 Year | 184.0% |

| 3 Years | 373.4% |

| 5 Years | 284.8% |

NLC’s Record high sales in Decades

Fundamentally NLC has performed really well amid rise in power demand. From ₹11,947 Crores in 2022 to ₹16,165 crores in 2023, its sales growth rate stands at 35.3% which is highest in the last ten years.

Not only sales, but the company has also displayed improved profits. In the last quarter of 2022, NLC’s reported loss was 406.74 crores. But the company made net profits of ₹250.42 crores in December 2023.

Annual profit growth of NLC

| Year | Net Profit (₹ Cr.) | Annual Profit Growth |

|---|---|---|

| MAR 2019 | 1,232.77 | - |

| MAR 2020 | 1,288.49 | 4.51% |

| MAR 2021 | 1,042.50 | -19.05% |

| MAR 2022 | 1,263.54 | 21.21% |

| MAR 2023 | 1,248.22 | -1.21% |

NLC undervalued ? P/E ratio says so!

One criteria that investors often look at is the Price-to-Earnings (P/E) ratio in order to determine a company’s valuation. NLC has a P/E ratio of 11.93 which is significantly lower than the average P/E ratio of its competitors, which is 25.5.

NLCINDIA’s lower PE might make it attractive to investors as they may consider the stock undervalued compared to its industry peers. It’s important to note that the P/E ratio itself should not be used to determine valuation of stock. It should be used as a base and other factors like company’s growth prospects, competitive advantages, and overall financial health should also be used.

NLC's P/E vs Peers

| Company | PE Ratio |

|---|---|

| JSW Energy | 50.8x |

| Jaiprakash Power Ventures | 28.2x |

| NLC India | 11.9x |

| PTC India | 10.5x |

Technical Reason Behind fall in price of NLC

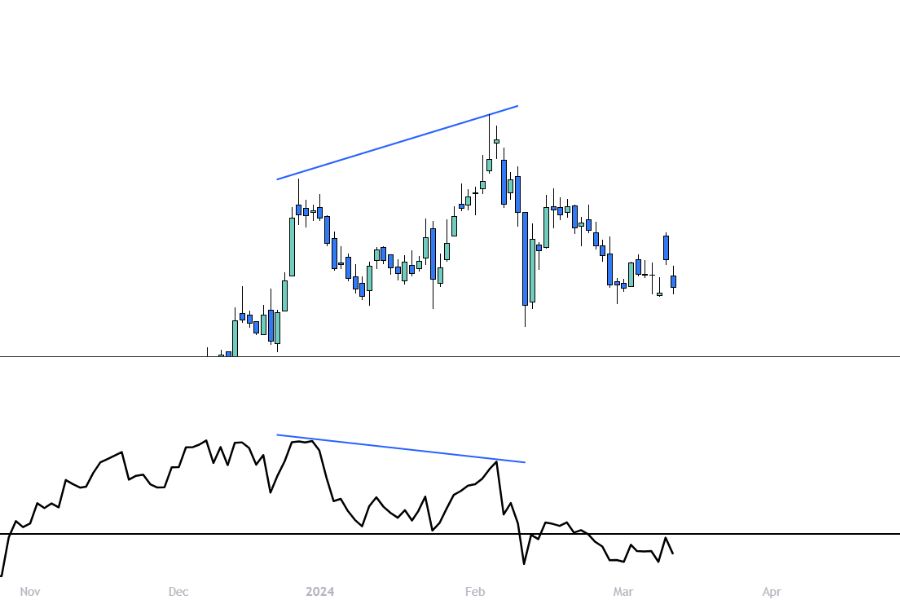

When NLC made a high of ₹266.70 in December 2023, its RSI peaked at 81. This high was however breached in February, after which a new high of ₹293.75 was marked by the company. But, during this period, NLC’s RSI was at 72, which was lower when compared to RSI value at its previous high.

Formation of Higher Highs on price chart but lower lows on RSI shows weak momentum. This phenomenon is called ‘RSI Divergence’ in technical analysis. Later, NLC experienced negative sentiments as the bullish trend was weak and failed to sustain the high price.

Many trades use RSI Divergence to initiate a short (sell) position positionally in futures or to exit from an existing trend considering it as weak. This might be one of the reasons behind fall in price of NLC.

Finally

NLC has not yet closed below its monthly candle. Even though in a shorter time frame it might appear very bearish, its long term structure is still bullish. ₹186 will act as strong support if the stock falls further down.

Long term investors should keep track on its forecasted revenues and fundaments. Since NLC’s profits are volatile, it may experince mixed sentiments based on its financial performance.

Share this insight

Spread the Alpha

If this analysis helped you, pass it along to your trading desk or community.

Related Articles

More ideas that align with your trading playbook.

Amber Enterprises (BSE: 540902): Bullish Flag Pattern— Is the Upward Momentum Set to Continue?

Amber Enterprises (NSE:AMBER) (BSE:540902) is a small cap stock with MCAP of 15,364 crores and operates in the consumer durable sector. The…

Breakout stock for Swing Trade – Garware Technical Fibres (NSE:GARFIBRES)

Garware Technical Fibres Ltd. (NSE:GARFIBRES) (BSE:509557) works in the textile domain and is a leading manufacturer of technical fibres like fishing and…

Hindustan zinc rises before earning concall, Should you hold?

Hindustan Zinc which is listed on NSE under ticket (NSE:HINDZINC) marked a new all time high on April 12, 2024. The stock…

Your writing style is so engaging and easy to follow I find myself reading through each post without even realizing I’ve reached the end