Welcome to yet another post, traders! This post will discuss a stock that went from Rs 1043 to Rs. 1637 in less than three months! The company which we will talk about is India’s largest Structural Steel Tubing Company. This mid-cap company also has a presence in 20 other countries.

In a post earlier, we also talked about Lloyds steel which is a penny stock under ₹100. Lloyds steel is currently moving with high momentum just like the company we will discuss in this post.

Table of Contents

Can you guess the name of the company? The company we are talking about is none other than APL Apollo Tubes Limited (NSE:APLAPOLLO). APL Apollo Tubes is at its all-time high level of Rs. 1,638. The company has grown its profit by 26.59% in the last 5 years, by 31.46% in the previous 3 YEAR and an astonishing 86.71% in the last 1 YEAR. We can definitely see APLAPOLLO benefitting from this strong profit growth. Below are the financial statements of APL Apollo Tubes.

Apollo Tubes Financials

| PARTICULARS | JUN 2022 | SEP 2022 | DEC 2022 | MAR 2023 | JUN 2023 |

|---|---|---|---|---|---|

| Net Sales | 3,060.68 | 3,771.36 | 3,761.18 | 3,686.07 | 3,648.91 |

| Total Expenditure | 2,894.41 | 3,584.78 | 3,552.30 | 3,450.55 | 3,415.67 |

| Operating Profit | 166.27 | 186.58 | 208.88 | 235.52 | 233.24 |

| Other Income | 8.42 | 13.18 | 9.62 | 10.69 | 17.34 |

| Interest | 8.95 | 12.82 | 14.02 | 11.73 | 13.07 |

| Depreciation | 23.96 | 23.85 | 24.11 | 30.54 | 23.80 |

| Exceptional Items | 0 | 0 | 0 | 0 | 0 |

| Profit Before Tax | 141.78 | 163.09 | 180.37 | 203.94 | 213.71 |

| Tax | 36.35 | 41.62 | 47.19 | 52.08 | 53.14 |

| Profit After Tax | 105.43 | 121.47 | 133.18 | 151.86 | 160.57 |

| Adjusted EPS (Rs) | 4.21 | 4.38 | 4.80 | 5.48 | 5.79 |

The company seems to be doing quite well financially over the past few years. Their profits have grown by nearly a third over the last 3 years, which is great to see. Their revenue has also grown at a nice clip of about 15% per year.

APLAPOLLO seem to have no problem paying their interest expenses, with an interest coverage ratio of over 11. That means they have plenty of cushion to cover their interest payments. The company is also managing their cash flow efficiently. Their cash conversion cycle is negative, which means they are collecting from customers faster than they have to pay their own bills. This gives them flexibility with their cash flow. And their cash flow from operations compared to net profit looks healthy, too, at 1.62 times. So they are generating good cash flow relativew to their bottom line profits.

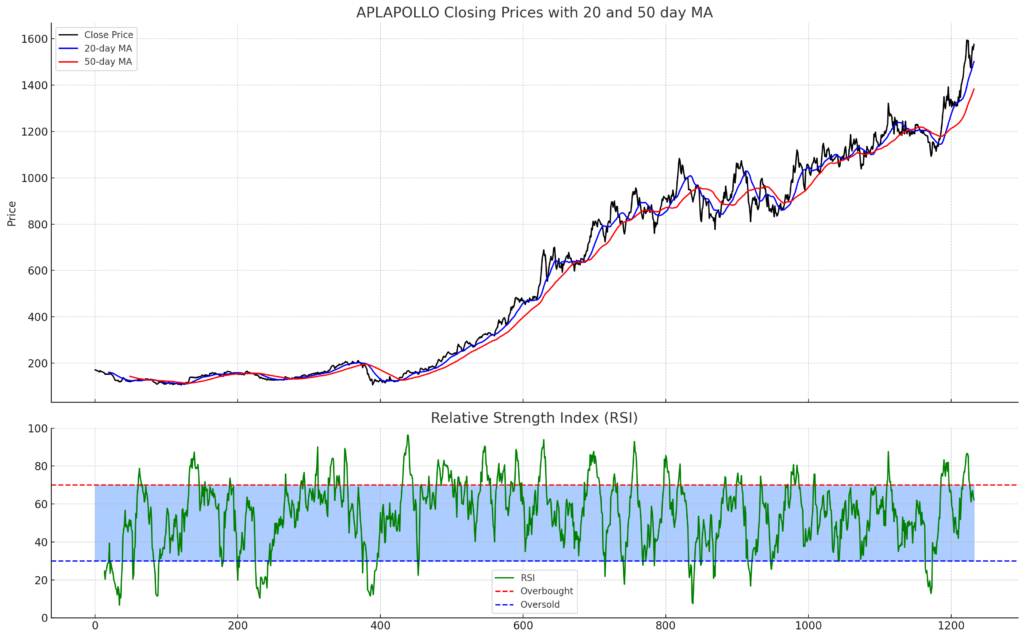

APLAPOLLO Technical Analysis

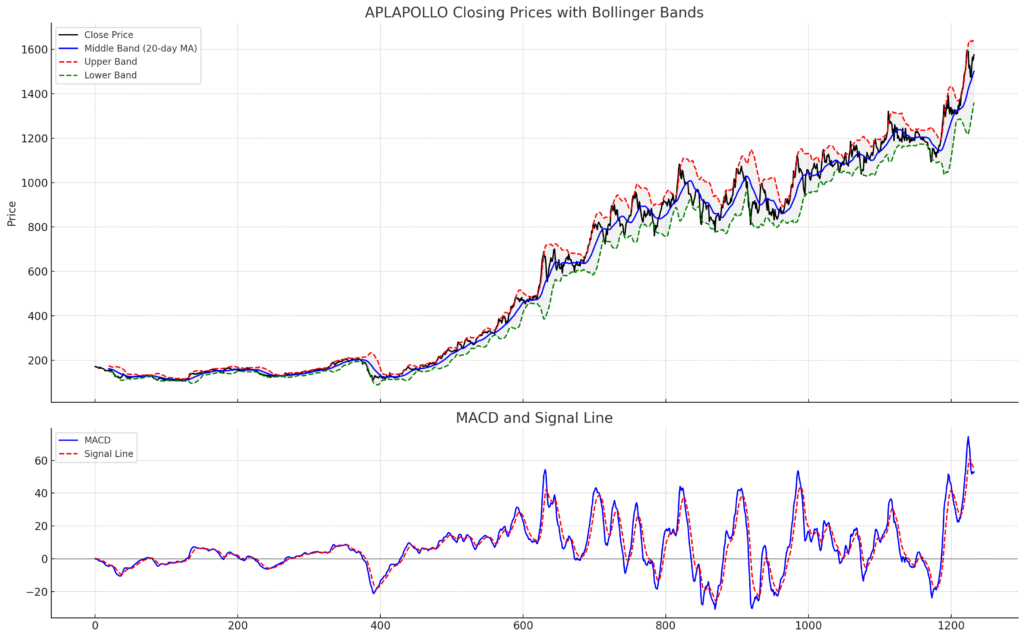

The top chart showcases the closing prices with Bollinger Bands. The bands represent the volatility of the stock price, with the middle band being the 20-day moving average, and the upper and lower bands being two standard deviations away from this middle band.

The above chart illustrates the MACD (blue) and its Signal Line (red dashed). When the MACD crosses above the Signal Line, it can be seen as a bullish sign, and when it crosses below, it can be interpreted as a bearish sign.

Final Words

Overall, the financialsof APLAPOLLO is growing, with increasing profits and revenue well, has strong cash flow, and looks to be in a financially healthy position. The numbers look quite good for them over the past few years.