How To Become Financial Independent from Your Salary

Dailybulls Research

Contributor

People see “financial freedom” in various ways. For some, it means buying what they want whenever they want. Others see it as not stressing about bills or unexpected costs. Some just want to be free of debt, while others aim to be wealthy enough to retire. Though these views are somewhat right, they are only part of the picture.

Ironically, financial freedom is really about having control over your money. It’s about being in charge of your finances. Let’s explore how to achieve financial freedom through saving and investing.

Steps To Achieve Financial Independence

1. Create Your Budget

Think of budgeting as a partner to saving money. It helps you pinpoint areas where you can spend less and put more money aside. With a solid budget, you can grow your savings while still indulging in activities you enjoy. Following the 50-30-20 budgeting rule can guide you toward a financially secure lifestyle.

2. Monitor Your Expenses

Taking control of your finances starts with keeping track of your spending. You can do this in different ways, like using a notebook or an Excel spreadsheet. There are also budgeting apps with money tracker features available online.

Tracking expenses is crucial for financial freedom because it holds you accountable. It helps uncover unnecessary purchases made on impulse, which can hinder your journey to financial independence.

Therefore, it’s essential to stay in control by consistently tracking your spending.

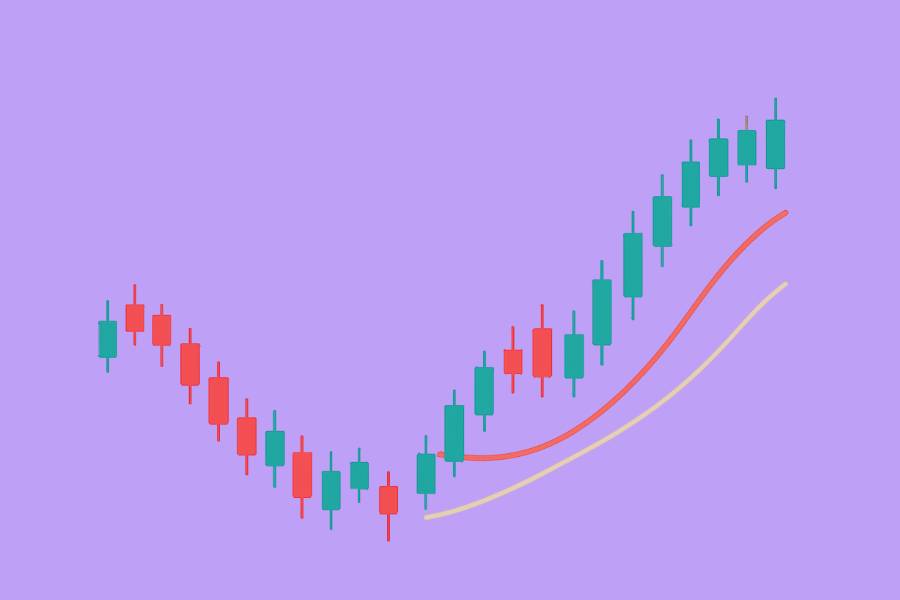

3. Invest in the Stock Market

If you want your money to grow, investing in the stock market is a great option. Here are three ways you can do it:

a. Direct Stock Investment:

If you’re well-versed in stock market operations and trading, you can opt for direct stock investment. Conduct fundamental analysis to make informed decisions about which companies to invest in. Once you’ve identified potential investments, reach out to a broker to open demat and trading accounts. These accounts will enable you to purchase shares of the companies you want to invest in.

b. Mutual Funds:

Mutual funds offer a diversified approach to investing by spreading risk across various stocks. If you lack expertise or time for market analysis, consider seeking assistance from asset management companies. They can advise you on selecting mutual funds aligned with your financial goals. Keep in mind that you may incur commission fees for their services. Investing in mutual funds allows you to diversify risk across multiple sectors and securities.

c. Tax-Saving Funds:

Looking to save on taxes? Tax-saving mutual funds are a winner. They not only help you with tax benefits but also promise solid returns. These funds are crafted to give you the best of both worlds – tax savings and a handsome return on your investment.

4. Invest in Savings Scheme

If you want your money to grow, consider investing in a Savings Scheme for your financial goals. Here are some options:

1. PPF (Public Provident Fund)

A PPF is a long-term investment supported by the Government of India. Deposits in a PPF qualify for tax deductions under Section 80C. Any resident Indian individual, whether salaried or non-salaried, can open a PPF account. The lock-in period is 15 years, extendable by 5 years, and partial withdrawals are allowed after 7 years.

2. Fixed Deposit

Tax-saving fixed deposits function similarly to standard fixed deposits, with the distinction of a mandatory 5-year lock-in period. Additionally, investors can avail themselves of tax benefits under Section 80C for investments up to Rs 1.5 lakh. Resident Indian individuals can open these FDs, and they also have a 5-year lock-in period. Since investing in this is a long-term commitment, searching for the best fixed deposit interest rates is recommended before finalising your decision.

3. National Pension Scheme

The NPS is a retirement plan created by the Indian Government for people in the unorganised sector and working professionals. With NPS, individuals can save for retirement.

Investments up to Rs 1.5 lakh in NPS qualify for tax deductions under Section 80C. Any Indian citizen aged 18 to 60 can open an NPS account. After 15 years, partial withdrawals are allowed under specific conditions.

4. Senior Citizen Saving Scheme (SCSS):

SCSS is designed for senior citizens in India, particularly those aged 60 and above. It provides a secure way to invest money and offers tax benefits.

Indian senior citizens can invest a lump sum individually or jointly in SCSS and receive regular income along with tax advantages.

5. Debt Management

Paying off a hefty debt is key to achieving financial freedom in various ways. It frees up your future cash flow, strengthens your credit score, and, most importantly, alleviates a significant burden.

Two primary methods exist for debt repayment. The snowball method involves starting with the smallest debt and then moving on to larger ones, like ticking items off a checklist. The avalanche method prioritises paying off the debt with the highest interest rate first before tackling others.

Both approaches are effective, and if you’re facing a mountain of debt, it’s essential to choose the one that suits you best. Nonetheless, eliminating debt remains a critical factor in securing financial independence.

Closing Thoughts

Financial freedom isn’t just a pipe dream – it’s within your reach. With a little budgeting, smart investing, and debt management, you can take charge of your finances and build the life you want. So, what are you waiting for? Start your journey to financial independence today!

Share this insight

Spread the Alpha

If this analysis helped you, pass it along to your trading desk or community.

Related Articles

More ideas that align with your trading playbook.

Understanding Online Trading Accounts and How to Open One in India

Introduction to Online Trading Accounts First things first, let’s come to the definition of online trading. Online trading is a method that…

7 Key Tips to Save Money on Health Insurance Premiums

With the ever-increasing costs of healthcare in India, securing a health insurance policy has become more of a necessity than an option.…

5 Financial Tips for Beginners

Mastering personal finances is one of the most basic yet important skills that helps you achieve your short-term and long-term goals. Understanding…