Tata Steel Share price target 2023, 2024, 2025, 2030

Welcome to yet another article, traders! As economies worldwide are growing, including India, the demand for steel is growing at a paster pace then ever. By the year 2025, the Indian steel demand is expected to grow 7-8% each year. When it comes to the top steel producer in India, Tata Steel is a company that comes to our mind. But, it is right timeto invest in Tata steel and, What can be the share price target for Tata Steel in 2023, 2024 , 2025 and upto 2030?

In order to find the share price target for future Tata Steel , we will study the company’s fundamentals and compare its current and past performance.

Several shares from the TATA Group like TATA Elxsi have generated massive wealth for investors. The current share price of Tata Steel is ₹111.10. Let’s see if the stock can double its value in the coming years.

Tata Steel Company details

Tata Steel is a subsidiary of the renowned Tata Group. The company is a global steel producer with a remarkable history spanning over a century. Since its establishment in 1907, Tata Steel has grown into one of the largest steel manufacturers worldwide, known for its unwavering focus on quality, innovation, and sustainability.

Tata Steel operates across multiple continents, including Europe, Asia, and Africa. The company has a diverse range of steel products, including flat steel, long steel, tubes, and pipes, catering to various industries such as automotive, construction, infrastructure, and packaging.

Tata Steel share price target 2023

Over the years, Tata Steel has showcased steady growth. The company has proved that it can overcome any financial difficulty quickly. From March 2019 to March 2023, the company’s total shareholder funds increased from Rs. 70,454.71 Cr to Rs. 134,797.51 Cr.

This steep increase in shareholder funds indicated growing interest of the investors towards the company. It is a positive sign for the company’s financial health. Tata Steel’s share price target in 2023 will be in the range of Rs 115.65 to 127.

Tata steel technical chart for 2023

If we check the technicals in the above chart, we can clearly observe a rounding bottom pattern formation. When such a pattern is formed, it highlights the end of a downtrend, which may mean long-term price reversal.

Furthermore, the company’s total assets grew remarkably from Rs. 137,498.36 Cr in March 2019 to Rs. 233,791.42 Cr in March 2023. This expansion reflects the company’s strategic investments in fixed assets, non-current investments, and other non-current assets. These growing numbers signify Tata Steel’s commitment to enhancing its infrastructure and positioning itself for future growth.

Tata Steel share price target 2024

Tata Steel share price target is expected to be in range of Rs 147 to 162. The company’s net sales have shown a steady upward trend over the past years, growing from INR 70,610.92 Cr. in March 2019 to INR 1,29,006.62 Cr. in March 2023. However, it’s important to note a slight decline in net sales in the most recent quarter (March 2023) compared to the previous quarter (December 2022).

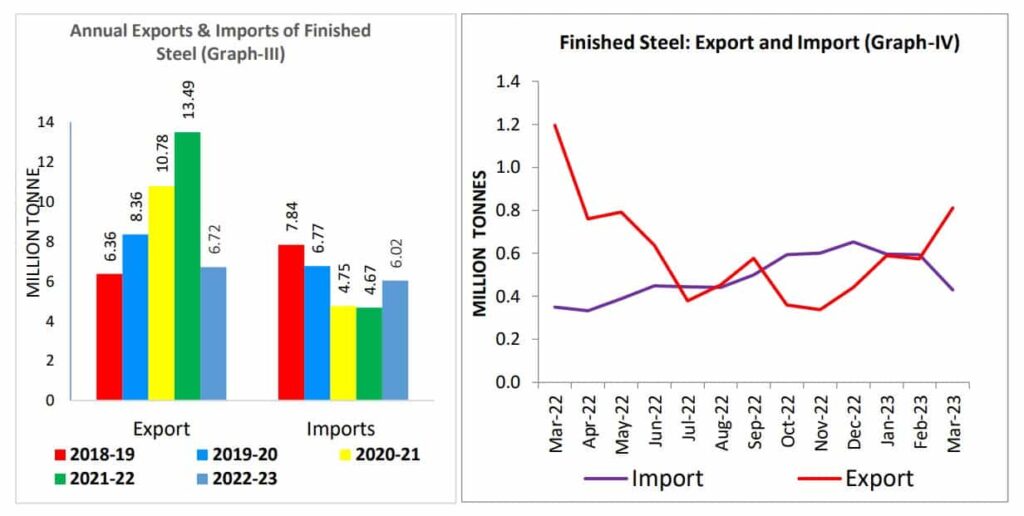

Check out the above image, which displays Annual Exports & Imports of Finished Steel in India. India’s steel export was highest in 2022 at 13.49 Million Tons. Looking at the monthly export chart, we can see a decline in exports from Dec 2022 to Mar 2023. (Source : steel.gov.in )

Higher exports means higher Profits!

Exports are significant for steel companies as they can earn a big chunk of profits. The decline in India’s steel exports can be because of reduced demand for Indian-origin hot-rolled products. The market is now flooded with competitively priced steel from the UAE, which has led buyers to seek lower prices. Unfortunately, Indian steel mills seem uninterested in reducing production costs to stay competitive.

Tata Steel share price target 2025

Tata Steel’s operating profit has displayed a mixed trend over the years, with notable growth in a few quarters. Firstly, the operating profit stood at INR 27,701.97 Cr in March 2023. This was a decline compared to the previous quarter (December 2022). But as we discussed earlier, the company’s profits were highest in 2022 due to larger exports, and we may continue to see such fluctuations in the coming years

Looking at the other income, which includes non-operational revenue streams we can see overall positive trajectory. However, similar to the operating profits, other income also experienced a slight decline in the most recent quarter, totalling INR 3,325.48 Cr. In 2025 Tata Steel’s share price target will be ₹ 184 as our first target and ₹211 as our second target.

Expected share price target of Tata Steel in 2026

Based on our analysis, the share price target of TATA Steel in the year 2026 will be ₹247 as our minimum target. Th maximum target that TATA Steel can achieve in 2026 is ₹291 which the comapny is expected to reach by Q3 of 2026.

Expected share price target of Tata Steel in 2027

As per Gann’s level, Tata steel’s share price is expected to be in between ₹370 to ₹419 in the year 2027.

Expected share price target of Tata Steel in 2028

- The first share price target for TATA Steel in the year 2028 is ₹495

- The Second share price target for TATA Steel in the year 2028 is ₹548

Tata Steel's Share price Target from 2023 to 2030

In the year 2029, as per multiple analysis, the expected share price target of TATA Steel is in between ₹586 and ₹628.

Tata Steel's share price target for 2029

| Year | 1st Target (Rs) | 2nd Target (Rs) |

|---|---|---|

| 2023 | 115 | 127 |

| 2024 | 147 | 162 |

| 2025 | 184 | 211 |

| 2026 | 247 | 291 |

| 2027 | 370 | 419 |

| 2028 | 495 | 548 |

| 2029 | 586 | 628 |

| 2030 | 727 | 841 |

In the above table I have mentioned expected share price targets for Tata Steel Ltd for up to 2030. However, it is important to note that these Tata Steels share price targets are based on historical data, and future expectations will depend on various factors, including the company’s strategies, industry trends, and economic conditions.

Similarly, Several Export policies by the Government can also affect the metal sector’s short term performance. Now let us look into the company’s fundamentals and analyse targets for each year individually.

What is the future of Tata Steel stock?

The future of Tata Steel is both exciting and challenging. Despite facing some recent setbacks in terms of financial performance. Tata Steel has a solid foundation and a proven history of growth. As I analyze their balance sheets, I see numerous opportunities for them to thrive in the coming years.

Tata Steel is in a prime position to capitalize on the rising demand for steel, especially in sectors like construction, infrastructure development, and automotive manufacturing. Interestingly, as economies are recovering from the global pandemic, the focus on investing in infrastructure projects has been increased. This will undoubtedly boost the demand for Tata Steel’s products.

How is Tata Steel for long term?

Tata Steel has recognized the importance of sustainability and has actively invested in green initiatives. This strategic move aligns perfectly with the increasing global demand for environmentally friendly practices and sustainable steel.

By focusing on eco-friendly manufacturing and addressing sustainability concerns, the company can expand its market share and meet the changing preferences of customers. This makes Tata steel a good choice to buy for long term in 2023.

Did you know?

The Singapore Government has more then 1% stake in Tata steel. Check list of more such Indian companies that Government of Singapore holds

Tata Steel Dividend 2023

| EX DATE | RECORD DATE | DIVIDEND% | AmountRs. | TYPE |

|---|---|---|---|---|

| 22 Jun 2023 | 23 Jun 2023 | 360 | 3.6 | Final |

| 15 Jun 2022 | 17 Jun 2022 | 510 | 51 | Final |

| 17 Jun 2021 | 19 Jun 2021 | 250 | 25 | Final |

| 06 Aug 2020 | 08 Aug 2020 | 100 | 10 | Final |

| 04 Jul 2019 | 06 Jul 2019 | 130 | 13 | Final |

Conclusion

Hopefully these Share price targets for TATA Steel will give you an edge in your investment journey. The company has displayed impressive growth in net sales and profitability over the years, but recent declines in key financial indicators require immediate attention. By focusing on cost optimization, diversification, market research, and sustainability initiatives, Tata Steel can position itself for sustainable growth and enhanced shareholder value.

Investors should closely monitor the company’s strategic actions and future financial reports to assess its progress towards achieving these objectives. Please consult an investment advisor before making any investments.

FAQs

What is 52 Week High and Low of Tata Steel?

Tata Steel’s 52 WEEK HIGH is ₹ 124.30 and 52 WEEK LOW is ₹ 83.81.

How is Tata Steel's current valuation?

Tata Steel is currently at an expensive valuation on paper. The P/E, P/B and P/S ratios are high compared to the industry average.

Who are Tata Steel's competitors ?

JWS Steel, Jindal Stainless, SAIL, Ratnamani Metals are all Tata Steel’s competitors.

About the author

Dailybulls Research

Senior Researcher and Editor

Dailybulls Research Team consists of experienced market analyst from multiple domains like equity, futures and options, forex and commodities. The team is focused on providing data backed research, powered by Ai and machine learning algorithms.

Share this insight

Spread the Alpha

If this analysis helped you, pass it along to your trading desk or community.

Related Articles

More ideas that align with your trading playbook.

Jana Small Finance Bank (JSFB) Share Price Target 2024, 2025, upto 2030

Tanla Platforms Ltd (NSE:TANLA) Share Price Target 2024, 2025, 2026, 2027, 2028 upto 2030 with detailed technical analysis report

RVNL Future Analysis 2024, 2025, upto 2030

Data Patterns (India) Ltd (NSE:DATAPATTNS) Share Price Target 2024, 2025, 2026, 2027, 2028 upto 2030 with detailed technical analysis report

Data Patterns (India) Ltd (DATAPATTNS) Share Price Target 2024, 2025, upto 2030

Data Patterns (India) Ltd (NSE:DATAPATTNS) Share Price Target 2024, 2025, 2026, 2027, 2028 upto 2030 with detailed technical analysis report